Discretionary Trust

A trust is a structure created by executing a trust deed, where a trustee, who can be an individual or a company, holds and manages assets for the benefit of the beneficiaries of that trust.

Day to day operating your business through a trust is no different from operating as a partnership or sole trader, the trust has an ABN and can have a Trading Name.

The main difference is that at the end of the year the results of carrying on the operations of the trust flow to those beneficiaries in the form of trust distribution.

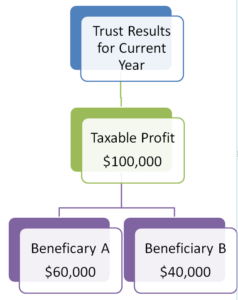

For example, if the Discretionary Trust makes a taxable profit for the year that profit will be distributed out to the beneficiaries of the trust as decided by the trustee, based on what the Trust Deed allows the Trustee to do.

In this example, the Trust made a profit of $100,000 which the trustee decided to allocate as $60,000 to Beneficiary A and $40,000 to Beneficiary B.

If this business was operated as a Sole Trader the owner would be responsible for paying tax on the entire taxable profit of $100,000.

If that same business was operated as a standard Partnership (50: 50) each partner would have to include $50,000 of the taxable profit in their individual tax returns.

That ability to choose who of the possible beneficiaries will be allocated taxable profit each year is the greatest tax benefit of using a trust. That flexibility allows for good tax planning and can greatly help to minimise the total income tax paid of the profit of the trust.

Trusts are treated as a separate entity for taxation purposes. The trustee must apply for a Tax File Number (TFN) for the trust and lodge an annual income tax return, however the liability of the tax due on the taxable profit also flows to the recipients of that profit.

One of the drawbacks to choosing a trust to operate a business in is that, unlike companies, trusts are not separate legal entities; the assets of the Trust are owned and controlled by the Trustee and the liability of the trust sits with the trustee. So if it all goes wrong the buck literally stops with the trustee.

When you go through the process of creating your Family Trust you have to choose what type of trustee you want to control the trust. The trustee may be one or more individuals, or a private company (corporate trustee) specifically setup to act as trustee.

The exact choice of Trustee is a very important one and should be considered very carefully.

Pingback: Checklist for How to Change to a Trading Trust | Exact Accounting