When do I need a Logbook for Business Vehicle?

The simple answer is when the Taxman considers that you are driving a “Car” rather than a Motor Vehicle you need to do a logbook to give yourself the best possible deduction for you. This is where tax terminology gets confusing as it goes against what most people would assume.

For tax purposes even though you might be getting from A to B in an engine powered Ute with a tray it may be classed as a car not a commercial vehicle. For example a lot of dual cabs are deemed to be “Cars”, whereas not many of us wouldn’t refer to our ute as a car.

Why this is important is that a “Car” is limited to being claimed by either its logbook percentage or the number of kilometres it has traveled for business capped at 5000 km. A commercial vehicle can often be claimed at 100% of its costs.

What am I Driving, a Car or a Vehicle?

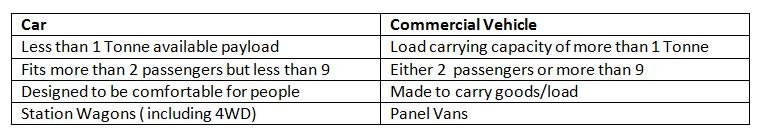

Sounds like a ridiculous question, doesn't it? But it is not fact that you drive a utility, if it is has signage on it or if the back of it is loaded up with your tools that effects how that vehicle is viewed for tax purposes. The factors below are what are used to determining if your daily driver is going to be considered a commercial motor vehicle or fall into the car category:

TIP: if what you drive for work is falls into the category of a “Car” and you don’t have a valid logbook for your “Car” you can only claim the Km’s, which for the 2018/2019 year will be a maximum deduction of $3,400. Most utilities and 4wd cost far more than that to run for a year.

Be Sure of your Carrying Capacity

Not all Utes are the same and there can be huge difference in the payload available between makes and models. If you want your daily drive to be as tax effective as possible, check out its specs before you buy.

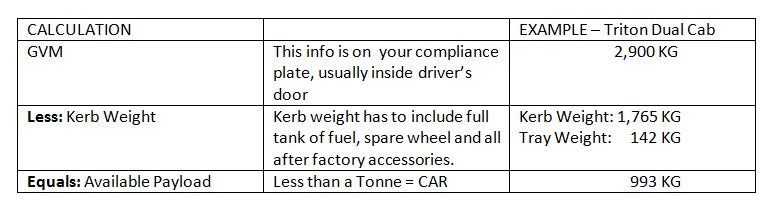

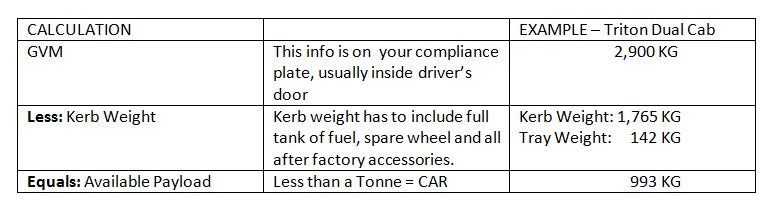

Remember that the main factor for how your drive is categorised depends on its available payload. To work out the payload for tax purposes it is the GVM less the Kerb Weight. If that leaves you with more than a tonne to spare you are driving a Motor Vehicle (per tax lingo) rather than a Car.

Kerb weight has to include full tank of fuel, spare wheel and all of your accessories, like a tray. If you have fruited up your ride with canopy, bulbar, side steps or bar work that all has to be included as your unladen vehicle weight.

TIP: If you are left with less than a tonne to work with than please do a logbook.

What classed as a Car means?

Being called a Car isn’t really that bad, it really is means that you should put in the effort to fill out a logbook for a 12 week period that represents the average business use.

How a Logbook Works for You

By accurately completing a logbook that shows the pattern of use for your work vehicle it gives your accountant the business use percentage for the Car. That percentage can be whatever the logbook records support. Once we have your logbook percentage that allows us to claim a deduction of all the motor vehicle expenses for the year at that percentage.

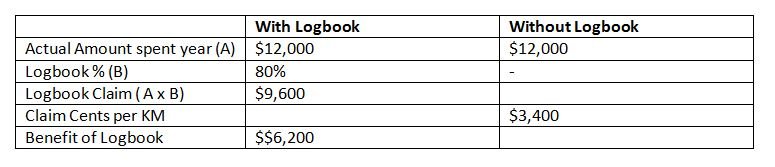

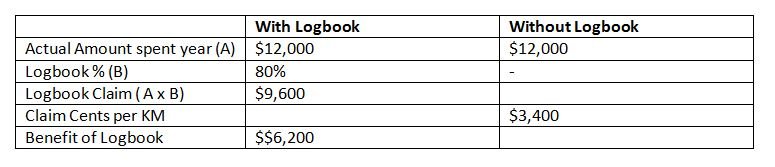

So say for example that your logbook shows that you use the Ute for 80% business related stuff and private use is 20%, and your total costs for year are $12,000.

From my example you can see that by using an accurate logbook this taxpayer would benefit from being able to claim an additional $6,200 deduction for motor vehicle expenses, compared to only being able to use the cents per km method. No logbook for Car = only can claim per KM

Please see my article

Logbook Requirements to make sure your logbook will be compliant.

What Else you Need

To make the most of your motor vehicle expense claim we need to know exactly how much you spent for the year on owning, running and maintaining your car or vehicle. Remember it is your Logbook % x Total Costs, so the more we know about the costs the better.

For the year keep good records of how much you have spent on each of these items:

- fuel and oil

- repairs and servicing

- interest on a motor vehicle loan

- lease payments (if any)

- insurance

- registration

Also we will need Purchase Cost & Date you bought your Vehicle so we can calculate any depreciation for you.

As with all tax deductions the more records you have prepared to bring to your Registered Tax Agent the better your tax result will be.

For further advice call Exact Accounting 0458 421 878 to make an appointment.

From my example you can see that by using an accurate logbook this taxpayer would benefit from being able to claim an additional $6,200 deduction for motor vehicle expenses, compared to only being able to use the cents per km method. No logbook for Car = only can claim per KM

Please see my article Logbook Requirements to make sure your logbook will be compliant.

From my example you can see that by using an accurate logbook this taxpayer would benefit from being able to claim an additional $6,200 deduction for motor vehicle expenses, compared to only being able to use the cents per km method. No logbook for Car = only can claim per KM

Please see my article Logbook Requirements to make sure your logbook will be compliant.