How do I get paid from my own business?

This exact question comes up quite a bit and my answers in this article relate to those of you who are running your business as a sole trader or partnership.

When you operate as a sole trader or a partnership you will pay income tax on your share of the taxable profit, regardless of how much cash you have or haven’t taken out of the business. You don’t actually get paid from your business if you trade under an ABN that is just you or a partnership, whatever your share of the bottom line of the Profit & Loss Report is allocated as your taxable income from that business.

This is can be a bit of a tricky concept to get your head wrapped around - that no matter how much or little of the assets of your business you use for yourself it doesn’t impact how much tax you will need to pay. I once had a client you very proudly told me he wouldn’t have any taxable income as he had left the business funds alone all year, unfortunately his theory didn’t work the way he had planned. It is not what you spend or save from the business, it is only your share of the profit that counts as your taxable income.

So when it comes to paying yourself from the business I would suggest that you need to decide how much the business can afford you to use for personal use based on cash flow. Balance up what the business cash needs are and what your own cash needs are, and remember that at anytime you can always add or subtract funds from either as you need to without impacting on your tax.

What about the Money?

When you work via a partnership structure or as a sole proprietor there is no legal difference between the assets of the business (including its cash) and those you own that have nothing to do with your enterprise. This means that what is in the business bank account is yours, and you can do with it what you like when you like. If you are in a partnership be nice and talk to your partner first before you empty out the business funds and agree on how much each of you can be "paid" from the business bank account.

The only exception to this is if you run out of cash and start using loans, credit cards or overdrafts to pay for your personal expenses. This type of borrowing is private and the fees on these amounts would be considered Drawings.

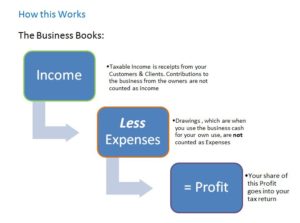

The amounts that you take from the business for your own use (which is whenever the money is not spent a deductible business expense) are called Drawings and have nil effect on the Profit calculation. Drawings are counted as part of your Equity, which is basically a running balance of what your business owes to you.

The same applies to the fund you contribute to your business; the amounts that you put in are part of your Equity in the business books. The amounts you put in don’t get added onto the Income, so won’t change the amount of Profit you have.

The exact take aways are:

- That if it doesn’t affect the Profit calculation then that transaction has no impact on what your taxable income is from the business.

- You will be taxed on your share of the business profit.

- Manage you business and personal cashflows to decide how much you can be paid

- This article does not apply to business that are run via a trust or company