How to Reconcile Kounta Receipts in QBO

Each time you complete your days takings at the End of the Day in Kounta your data will be exported directly into your QBO (provided you have set up the integration in Kounta) using the account information you provided to Kounta.

What Happens in your Quick Books?

Each End of Day process creates a Sales Invoice in your Quickbooks which is paid off in full automatically between the amount you told Kounta you had as EFTPOS sales and how much in cash.

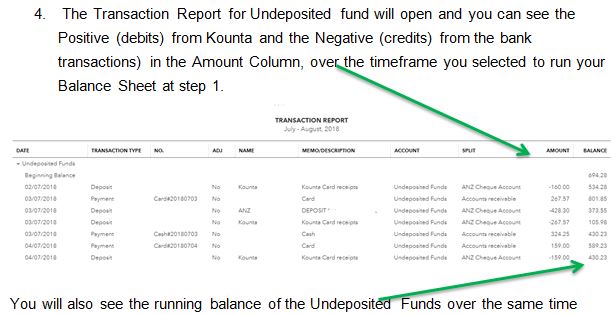

The cash and card amounts, that equal your day’s sales, will be posted in your QBO to the clearing account specified in Kounta. For us that will be into Undeposited Funds. You will see one entry per day for Cash and one for Card. These will show as a positive in your transaction in undeposited funds.

As funds are cleared from your bank they should be allocated back against the Undeposited Funds. These will shows as a negative figure in undeposited funds.

At the end of the month you should be able to balance Undeposited Funds back to nil as for every positive (Kounta receipt) there should be a matching negative (bank transaction).

HINT: Banking all of your cash takings on the last day of the month makes this process easier

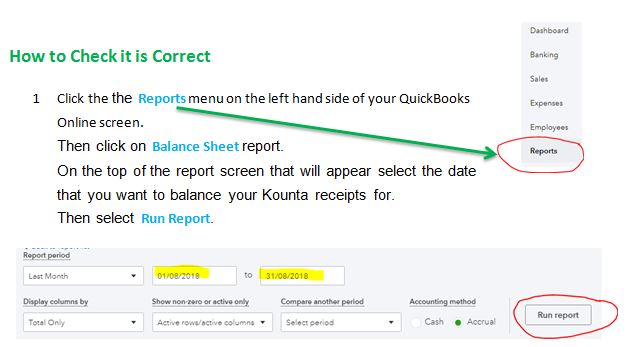

What we have to do is check that this amount is correct.

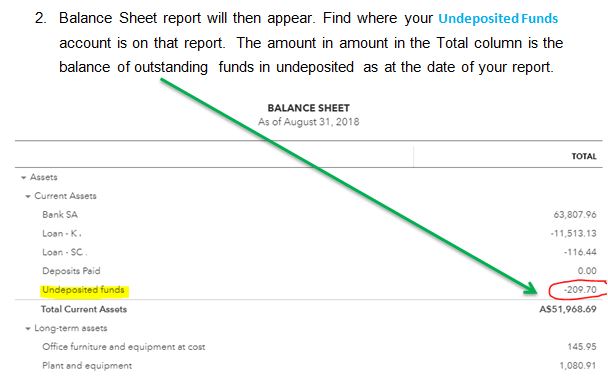

3. With your mouse take the cursor to sit on the Total amount for Undeposited Funds. In my example I would take my mouse to where the -209.70 is.

The number will change to blue underlined text, double click this.

5. The balance at the end of the report ( which will be as at whatever date you are balancing up to) should be the total of any uncleared eftpos transactions plus any cash takings you haven’t banked as yet.

In my example below if I have undeposited Funds balance on my balance sheet as at the 31/8/2018 of $430.23. When I take off the Cash I haven’t banked yet of $332.00 and the eft that hasn’t cleared into my account of $98.23 I can balance that figure back to nil. This means that my Undeposited Funds amount is correct for the period ending August 2018.

| 31/8/2018 | Balance Undeposited Funds | 430.23 |

| Less: | Cash on Hand | 332.00 |

| Less: | Uncleared Eftpos | 98.23 |

| Balance Remaining | 0 |

HINT: You are checking that the amount you have sitting as the balance of Undeposited Funds is accounted for by those transactions that haven’t hit your bank account in real life yet.

The amount of Undeposited Funds

Minus what you haven’t banked yet

Minus EFTPOS that haven’t settled yet

Should equal ZERO.