WORKING AT HOME

First off we have to figure out if you are working from home or are you a home based business?

This will make a difference to the type of expenses you can claim for. This article talks about what options you have in claiming tax deduction for the time you spend working at home, rather than operating a business.

Working from Home is you are employed by a business, i.e. you are on the payroll , and do some or all of that work at your place rather than at the office or workplace. It can also be when you have separate premises for your own business but also do some of the work for that business at your place.

If you run a business and home happens to be the place that you operate out of, please see Exact Accounting fact sheet for Home Based Business.

WHAT CAN I CLAIM FOR?

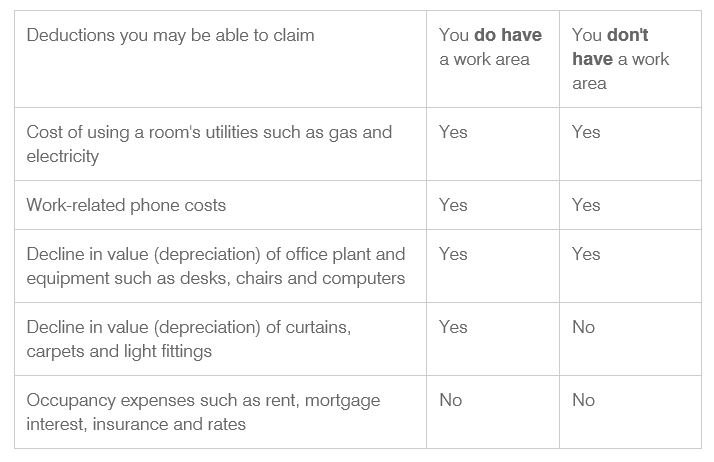

Firstly it depends on how you have set yourself up at home. If you have a separate office or study that you have kitted out to work in you should be able to claim some of the running costs of your home plus depreciation on the items you have bought to use in that space.

The fine print to this is that your work area has to be “set aside primarily or exclusively for work activities”, this means that use of that space that is not work related has to be minor. For example having a sofa bed in the study that only gets used 2 nights a year would be ok, but claiming that having a desk set up in the corner of your main living room is not.

If you have a separate work space:

You can claim a proportion of the costs of running your home, such as electricity, gas, WIFI data, telephone costs, repairs and cleaning costs. You are also able to claim depreciation on your work equipment, computers, furniture plus depreciation on the fixtures and fittings in your workspace. If you are working at home there is no deduction allowed for Occupancy Costs – such as rent, interest and council rates. Only the extra costs that you incur while you are at home producing income are deductible. Things like your council rates are the same cost whether you are at home or not, whereas your electricity costs will be higher the more you are working at home.

If you don’t have a separate work space but you do work at home:

The only claim you can’t make that you can if you have a separate space is you aren’t allowed a deduction for decline in the value of any fittings or fixtures.

HOW CAN I CLAIM?

1. Percentage of Actual Costs, this needs to be supported by evidence that proves the % of your bills you claim. You can choose to support your % claim using

a. Diary that keep records for how often you are working at home for at least a 4 week period, or

b. Based on floor area taken up by your Home office (if you have one), or

c. Claim the increase in your costs if you can compare the before and after average usage for each cost.

OR

2. Set Hourly Rate to keep things simple you can choose to use a fixed rate of 45 cents per hour for heating, cooling, lighting and the decline in value of furniture in your home office. If you elect to use the cents per hour method that rate set by the ATO just be aware that rate covers all the costs of working at home. You will also need to show diary as evidence of your average use for four week period.

As with all tax deductions the more records you have prepared to bring to your Registered Tax Agent the better your tax result will be.

For further exact advice call Excas Accounting to make an appointment.